.png)

Thailand Crypto Tax Guide 2024

Curious about crypto taxes in Thailand? Explore the comprehensive guide, from legalities to tracking transactions. Discover how to navigate the evolving tax landscape.

.png)

Curious about crypto taxes in Thailand? Explore the comprehensive guide, from legalities to tracking transactions. Discover how to navigate the evolving tax landscape.

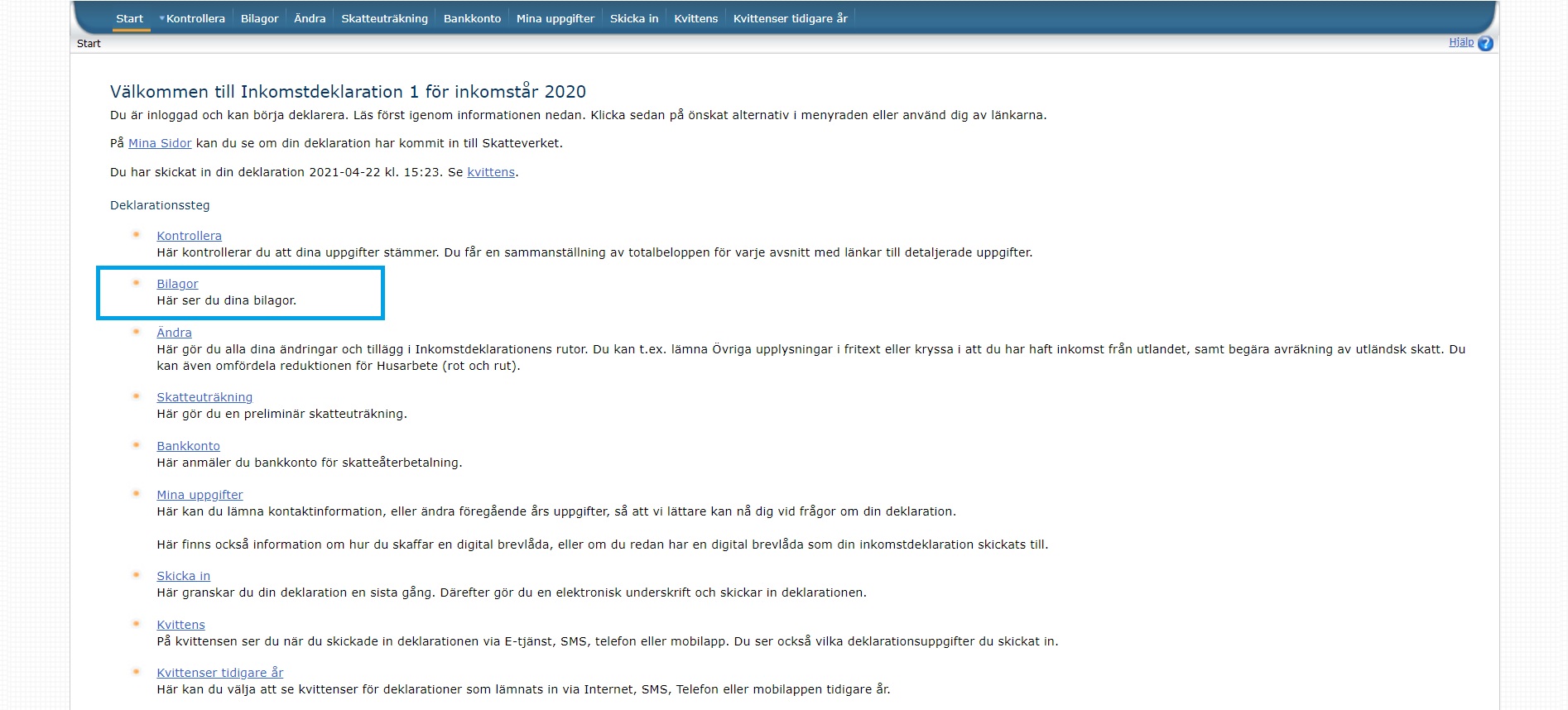

When transferring SRU files to the Swedish Tax Agency, the following two files must be transferred:

BLANKETTER.SRU

INFO.SRU

You may not rename the files after they have been created. If you do, the transfer will not work.

The form BLANKETTER.SRU must not be larger than 5 Mb.

Notice that BLANKETTER contains more information, it's the same information as in the k4 form section D but now in SRU code.

We at kryptos.io strive for the information to be correct in all respects. However, we can not guarantee this, and therefore can not take any responsibility for any losses caused by incorrect information on this web service. However, we are grateful for all remarks about inaccuracies. If you have found something that seems wrong, feel free to send us a message at contact@kryptos.io.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!