How Exchange Fees Can Reduce Your Crypto Taxes In USA

Learn how exchange fees can lower your crypto tax bill in the USA this year 2024.

Ever heard of Bitcoin Halving?

It’s essentially a cycle that governs bitcoin mining and ensures that the bitcoin network keeps running. 13 years ago when the genesis block of the Bitcoin network was mined, the reward was 50 bitcoins. In 2023, It’s down to 6.25 bitcoin after three subsequent bitcoin halving.

Isn’t that fascinating?

We mined 90.47% of the bitcoin supply in a little over a decade and it will take us another century to mine the remaining 9.53% of the supply, all thanks to a process called Bitcoin halving and it’s a fascinating feature of the Bitcoin network.

And by the time you’re done reading this extract, you will know everything there is to know about Bitcoin Halving.

So let’s jump straight into it.

“One of the most important features of Bitcoin is its limited supply and issuance mechanism,” says Bruce Fenton, CEO of fintech company Chainstone Labs. “Bitcoin provides certainty in an uncertain world. The code, not people, decide how it is issued.”

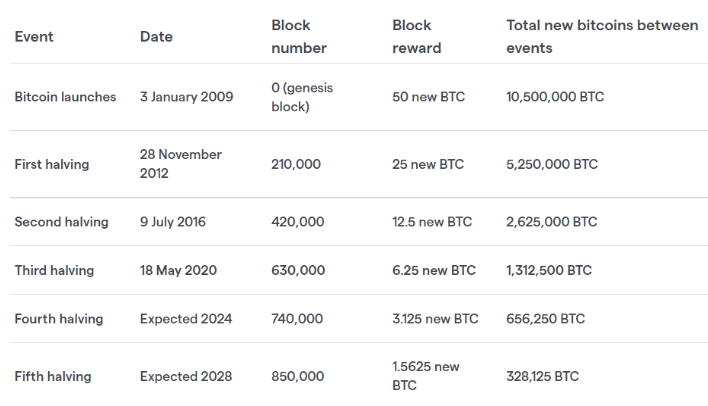

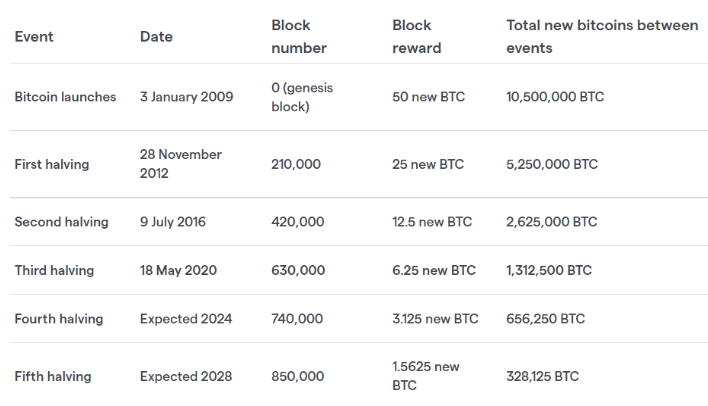

The algorithm proposes a halving after every 2,10,000 blocks of transactions have been verified by the miners, which takes roughly 4 years to complete. This process of reducing the mining rewards per block is called Bitcoin Halving or BTC Halving. Initially, the network rewarded 50 bitcoins for every verified block, 13 years, and 3 bitcoin halvings later, we now stand at 6.25 bitcoins per verified block.

Bitcoin being a Proof-of-work network runs on a decentralized network of validator nodes that facilitate, verify, and register transactions on the Bitcoin blockchain. Now, these validator nodes are responsible for verifying transactions to maintain the integrity of the network, and for every block of transactions that are verified, the miners receive 6.25 bitcoin as a reward.

With access to the current computing resources, it takes us almost 10 minutes to validate a block(and the transactions in it). Now according to the bitcoin mining algorithm, this reward is to be reduced by 50% after every 2,10,000 blocks are verified and added to the blockchain. And surprisingly when you convert minutes into hours, it comes down to 35,000 hours, that’s 1,458 days, and that’s 3 years and 363 days or approximately 4 years.

That’s why the bitcoin halving cycle repeats every 4 years.

When Satoshi Nakamoto proposed the concept of Bitcoin. He/she assumed the mass adoption of the concept across the globe and that would consequently imply a high valuation for the project and in turn a high token price. So the need for moderation of mining rewards in the future was evident to balance the limited supply.

Calculating over the entire duration of its existence, the bitcoin network has given away $5 billion per year as mining rewards on average, and with the ludicrous price movements and incessant bull runs driving the price through the roof, it’s only natural for the network to optimize the reward in a manner that conforms with the value proposition of the project.

The interplay between bitcoin mining and bitcoin halving is a crucial link to understanding the implications of bitcoin halving on the network. Mining does more than add new bitcoin to circulation, it is also the network’s defense mechanism against wrongdoers with malicious intent toward the network. It incentivizes using computing power to support the network, instead of using it for its destruction, say by double spending the same tokes, or by launching a denial-of-service attack on the network.

In the words of renowned crypto researcher Hasu:

“The game theory that secures Bitcoin requires that a) miners have an incentive to mine honest blocks [and] b) miners have a cost ... to attempting dishonesty.”

The rewards linked to supporting the network far outweigh the costs of attempting an attack on the network. However, with critical remarks from global leaders like Donald Trump, Joseph Stiglitz, and Joe Biden, attacks on the network are still a possibility. Therefore, the implications of bitcoin halving can be truly pivotal for the survival of the network in the long run.

As long as the incentives for supporting the network are above a profitable threshold that supports the costs linked to mining and leaves some money on the table, the network is presumably safe unless the motives are not political.

However, with mining rewards dwindling with every bitcoin halving and rising energy costs, consequent bitcoin halvings might harm the health of the network. Transaction fees on the network are one alternative to mining rewards. However, bitcoin supporters view it as a store of value like gold, instead of a medium of exchange.

Let's go by the conventional route of supply and demand. Bitcoin halving should theoretically increase bitcoin’s price because after every bitcoin halving the supply goes down by 50% for the next 4 years. Now even if we consider the demand a constant function instead of an increasing one, the price should ride an upswing.

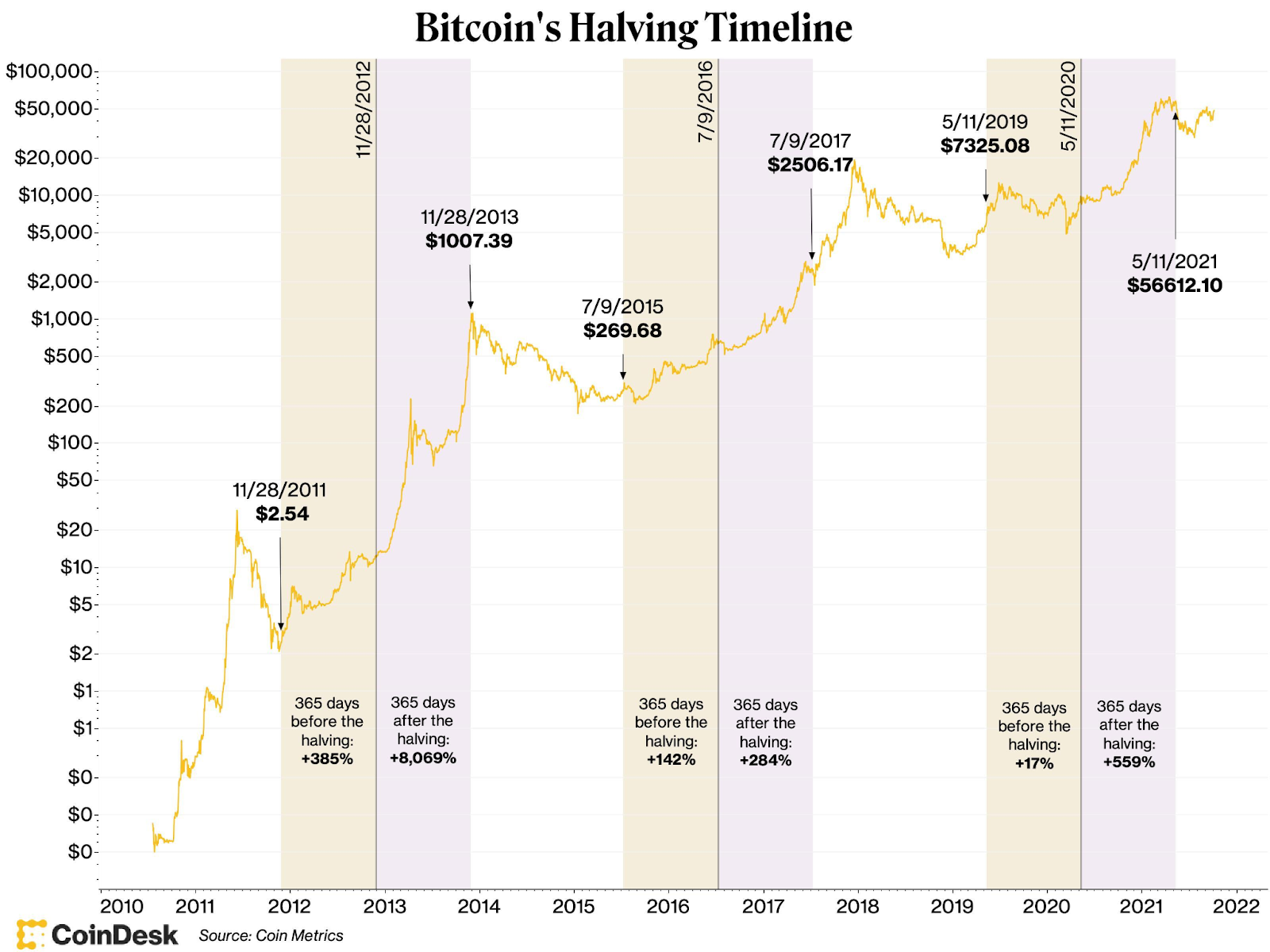

Even since bitcoin’s genesis block was mined, the network has gone through three bitcoin halvings, and each one of them has reaffirmed this logic. The figure given below depicts bitcoin’s price as a function of time in and around the halving years.

Source: Coin Metrics

As evident from the above figure, bitcoin’s price appears to be on an upswing that starts 365 days before the bitcoin halving and ends 365 days after that. And the chart retraces the same pattern before every bitcoin halving. Now, with the next bitcoin halving scheduled for June next year, predictions are positive. However, no one can be certain about the price movements because the economic conditions are not the same as they were before the last halving.

All the major decisions for the network are made by the algorithms without any human intervention. The bitcoin mining schedule is deeply ingrained in Bitcoin’s mining algorithm, which was supposedly coded by the anonymous creator(s) of the bitcoin network, famously known as Satoshi Nakamoto.

The goal of bitcoin was to offer an alternative to fiat currency and that would mean creating a dynamic monetary policy capable of dealing with inflation and deflation. Now at the time, Nakamoto had no possible way to extrapolate the extent of adoption of the bitcoin network, so he/she proposed a constant rate of reduction for mining rewards.

“Coins have to get initially distributed somehow, and a constant rate seems like the best formula,”

…wrote Nakamoto in the whitepaper, the constant rate being a reduction of 50% in the mining rewards after every 2,10,000 blocks are mined.

State-issued currencies have a multitude of tools at their disposal to add or remove currency from the markets. However, with a decentralized network like bitcoin, even the tiniest of changes need large-scale cooperation and planning. And this is exactly why the bitcoin network needs a meticulous mining schedule to maintain its efficacy and facilitate an optimal reward ratio for the contributors that offer the operative scaffolding for the network.

Bitcoin mining is a costly affair and unless the network offers an optimal reward for validating the transactions on the network, there’s no incentive to continue mining bitcoin. Let’s say miners have to spend an amount “T”(on energy costs, hardware costs, operational costs) for validating a block of transactions, then the network has to offer a mining reward “R” that’s greater than “T” for sustainable levels of miner activity, or the network collapses.

With every bitcoin halving, we are moving closer to the threshold value “T” on the bitcoin network and that’s a major concern. Bitcoin supporters propose a dynamic model that incentivizes miners to validate transactions by offering them a percentage of the transaction fees on the network. However, this model only holds when people use bitcoin for transactions, which is not the case in the current markets. Bitcoin is called “digital gold” and is considered a store of value commodity, not a digital currency. Although the last bitcoin will be mined somewhere around the year 2,140, the need for the proliferation of a global payment model that facilitates high volumes of bitcoin transactions is evident.

“In a few decades when the reward gets too small, the transaction fee will become the main compensation for nodes. I’m sure that in 20 years, there will either be very large transaction volume or no volume,” writes Nakamoto.

1. When was the date for the last Bitcoin Halving?

The last bitcoin halving occurred on May 11, 2020. The block reward was reduced from 12.5 Bitcoins per block to 6.25 Bitcoins per block. This reduction in the block reward has the effect of decreasing the rate at which new bitcoins are introduced into circulation. It is one of the key mechanisms by which the supply of bitcoin is controlled.

2. Briefly describe the Bitcoin Halving History.

Ever since bitcoin’s genesis block was mined back in 2009, the network has gone through three bitcoin halvings.

3. When is the next Bitcoin Halving cycle?

The next Bitcoin halving cycle starts June 2024, after the next halving successfully takes place. The mining rewards will be reduced from 6.25 bitcoin per block to 3.125 bitcoin per block. The cycle will run for the next 2,10,000 blocks starting at block 8,40,001 and ending at block 10,50,000. Assuming a linear growth in computing power, the cycle will end around May 2028.

4. Is Bitcoin Halving good or bad?

It is difficult to definitively say whether Bitcoin halving is good or bad, as it depends on the lens you view it with. From a purely economic perspective, halving can be seen as good because it reduces the rate at which new Bitcoins are introduced into circulation, potentially leading to increased scarcity and a higher price.

However, halving can also be seen as bad for miners, as it reduces the block reward that they receive for their work, which could potentially lead to a decrease in the security of the Bitcoin network if miners decide to leave. Ultimately, the long-term effects of halving the Bitcoin market and network are uncertain and will depend on a variety of factors.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

Ever heard of Bitcoin Halving?

It’s essentially a cycle that governs bitcoin mining and ensures that the bitcoin network keeps running. 13 years ago when the genesis block of the Bitcoin network was mined, the reward was 50 bitcoins. In 2023, It’s down to 6.25 bitcoin after three subsequent bitcoin halving.

Isn’t that fascinating?

We mined 90.47% of the bitcoin supply in a little over a decade and it will take us another century to mine the remaining 9.53% of the supply, all thanks to a process called Bitcoin halving and it’s a fascinating feature of the Bitcoin network.

And by the time you’re done reading this extract, you will know everything there is to know about Bitcoin Halving.

So let’s jump straight into it.

“One of the most important features of Bitcoin is its limited supply and issuance mechanism,” says Bruce Fenton, CEO of fintech company Chainstone Labs. “Bitcoin provides certainty in an uncertain world. The code, not people, decide how it is issued.”

The algorithm proposes a halving after every 2,10,000 blocks of transactions have been verified by the miners, which takes roughly 4 years to complete. This process of reducing the mining rewards per block is called Bitcoin Halving or BTC Halving. Initially, the network rewarded 50 bitcoins for every verified block, 13 years, and 3 bitcoin halvings later, we now stand at 6.25 bitcoins per verified block.

Bitcoin being a Proof-of-work network runs on a decentralized network of validator nodes that facilitate, verify, and register transactions on the Bitcoin blockchain. Now, these validator nodes are responsible for verifying transactions to maintain the integrity of the network, and for every block of transactions that are verified, the miners receive 6.25 bitcoin as a reward.

With access to the current computing resources, it takes us almost 10 minutes to validate a block(and the transactions in it). Now according to the bitcoin mining algorithm, this reward is to be reduced by 50% after every 2,10,000 blocks are verified and added to the blockchain. And surprisingly when you convert minutes into hours, it comes down to 35,000 hours, that’s 1,458 days, and that’s 3 years and 363 days or approximately 4 years.

That’s why the bitcoin halving cycle repeats every 4 years.

When Satoshi Nakamoto proposed the concept of Bitcoin. He/she assumed the mass adoption of the concept across the globe and that would consequently imply a high valuation for the project and in turn a high token price. So the need for moderation of mining rewards in the future was evident to balance the limited supply.

Calculating over the entire duration of its existence, the bitcoin network has given away $5 billion per year as mining rewards on average, and with the ludicrous price movements and incessant bull runs driving the price through the roof, it’s only natural for the network to optimize the reward in a manner that conforms with the value proposition of the project.

The interplay between bitcoin mining and bitcoin halving is a crucial link to understanding the implications of bitcoin halving on the network. Mining does more than add new bitcoin to circulation, it is also the network’s defense mechanism against wrongdoers with malicious intent toward the network. It incentivizes using computing power to support the network, instead of using it for its destruction, say by double spending the same tokes, or by launching a denial-of-service attack on the network.

In the words of renowned crypto researcher Hasu:

“The game theory that secures Bitcoin requires that a) miners have an incentive to mine honest blocks [and] b) miners have a cost ... to attempting dishonesty.”

The rewards linked to supporting the network far outweigh the costs of attempting an attack on the network. However, with critical remarks from global leaders like Donald Trump, Joseph Stiglitz, and Joe Biden, attacks on the network are still a possibility. Therefore, the implications of bitcoin halving can be truly pivotal for the survival of the network in the long run.

As long as the incentives for supporting the network are above a profitable threshold that supports the costs linked to mining and leaves some money on the table, the network is presumably safe unless the motives are not political.

However, with mining rewards dwindling with every bitcoin halving and rising energy costs, consequent bitcoin halvings might harm the health of the network. Transaction fees on the network are one alternative to mining rewards. However, bitcoin supporters view it as a store of value like gold, instead of a medium of exchange.

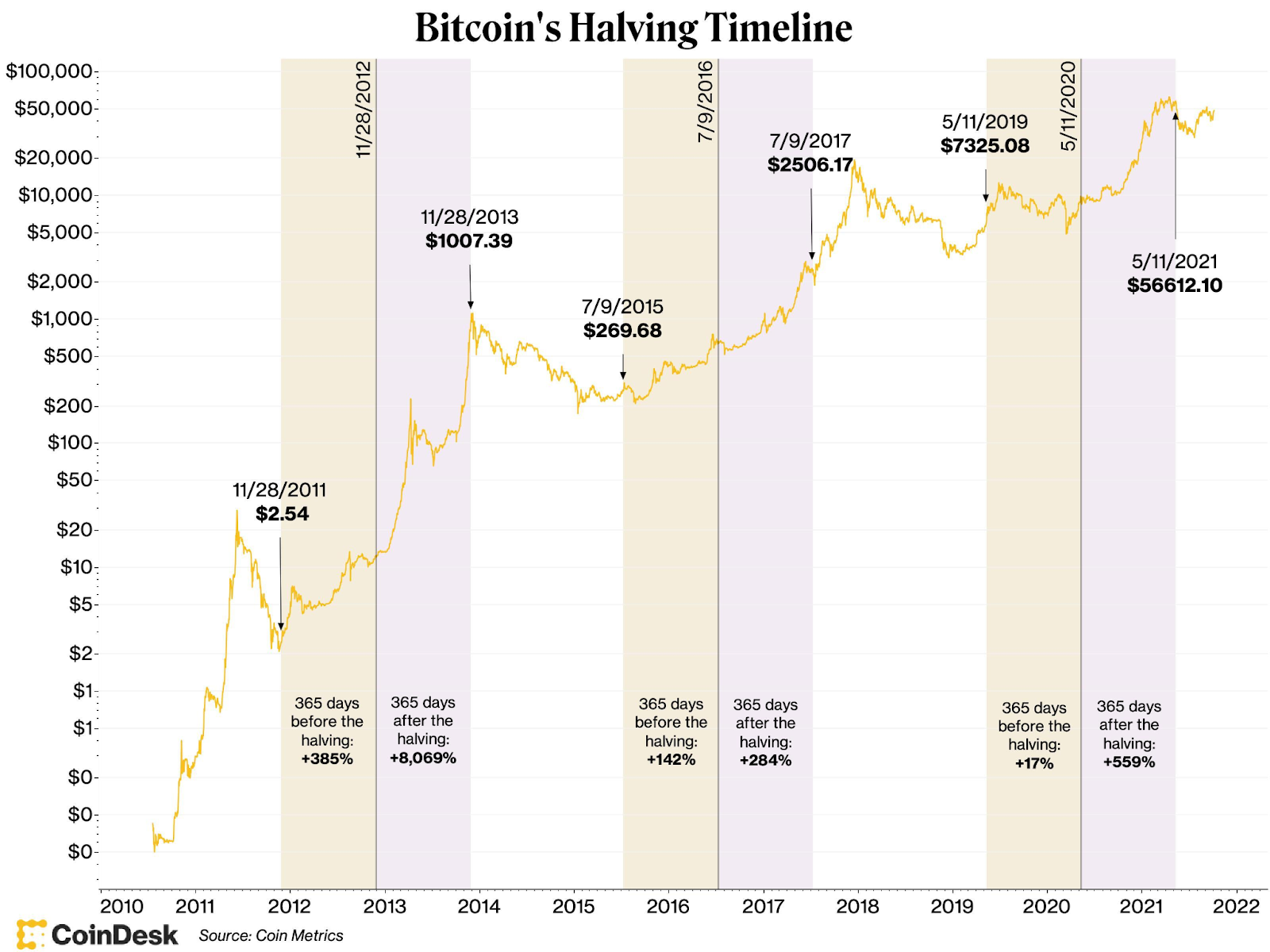

Let's go by the conventional route of supply and demand. Bitcoin halving should theoretically increase bitcoin’s price because after every bitcoin halving the supply goes down by 50% for the next 4 years. Now even if we consider the demand a constant function instead of an increasing one, the price should ride an upswing.

Even since bitcoin’s genesis block was mined, the network has gone through three bitcoin halvings, and each one of them has reaffirmed this logic. The figure given below depicts bitcoin’s price as a function of time in and around the halving years.

Source: Coin Metrics

As evident from the above figure, bitcoin’s price appears to be on an upswing that starts 365 days before the bitcoin halving and ends 365 days after that. And the chart retraces the same pattern before every bitcoin halving. Now, with the next bitcoin halving scheduled for June next year, predictions are positive. However, no one can be certain about the price movements because the economic conditions are not the same as they were before the last halving.

All the major decisions for the network are made by the algorithms without any human intervention. The bitcoin mining schedule is deeply ingrained in Bitcoin’s mining algorithm, which was supposedly coded by the anonymous creator(s) of the bitcoin network, famously known as Satoshi Nakamoto.

The goal of bitcoin was to offer an alternative to fiat currency and that would mean creating a dynamic monetary policy capable of dealing with inflation and deflation. Now at the time, Nakamoto had no possible way to extrapolate the extent of adoption of the bitcoin network, so he/she proposed a constant rate of reduction for mining rewards.

“Coins have to get initially distributed somehow, and a constant rate seems like the best formula,”

…wrote Nakamoto in the whitepaper, the constant rate being a reduction of 50% in the mining rewards after every 2,10,000 blocks are mined.

State-issued currencies have a multitude of tools at their disposal to add or remove currency from the markets. However, with a decentralized network like bitcoin, even the tiniest of changes need large-scale cooperation and planning. And this is exactly why the bitcoin network needs a meticulous mining schedule to maintain its efficacy and facilitate an optimal reward ratio for the contributors that offer the operative scaffolding for the network.

Bitcoin mining is a costly affair and unless the network offers an optimal reward for validating the transactions on the network, there’s no incentive to continue mining bitcoin. Let’s say miners have to spend an amount “T”(on energy costs, hardware costs, operational costs) for validating a block of transactions, then the network has to offer a mining reward “R” that’s greater than “T” for sustainable levels of miner activity, or the network collapses.

With every bitcoin halving, we are moving closer to the threshold value “T” on the bitcoin network and that’s a major concern. Bitcoin supporters propose a dynamic model that incentivizes miners to validate transactions by offering them a percentage of the transaction fees on the network. However, this model only holds when people use bitcoin for transactions, which is not the case in the current markets. Bitcoin is called “digital gold” and is considered a store of value commodity, not a digital currency. Although the last bitcoin will be mined somewhere around the year 2,140, the need for the proliferation of a global payment model that facilitates high volumes of bitcoin transactions is evident.

“In a few decades when the reward gets too small, the transaction fee will become the main compensation for nodes. I’m sure that in 20 years, there will either be very large transaction volume or no volume,” writes Nakamoto.

1. When was the date for the last Bitcoin Halving?

The last bitcoin halving occurred on May 11, 2020. The block reward was reduced from 12.5 Bitcoins per block to 6.25 Bitcoins per block. This reduction in the block reward has the effect of decreasing the rate at which new bitcoins are introduced into circulation. It is one of the key mechanisms by which the supply of bitcoin is controlled.

2. Briefly describe the Bitcoin Halving History.

Ever since bitcoin’s genesis block was mined back in 2009, the network has gone through three bitcoin halvings.

3. When is the next Bitcoin Halving cycle?

The next Bitcoin halving cycle starts June 2024, after the next halving successfully takes place. The mining rewards will be reduced from 6.25 bitcoin per block to 3.125 bitcoin per block. The cycle will run for the next 2,10,000 blocks starting at block 8,40,001 and ending at block 10,50,000. Assuming a linear growth in computing power, the cycle will end around May 2028.

4. Is Bitcoin Halving good or bad?

It is difficult to definitively say whether Bitcoin halving is good or bad, as it depends on the lens you view it with. From a purely economic perspective, halving can be seen as good because it reduces the rate at which new Bitcoins are introduced into circulation, potentially leading to increased scarcity and a higher price.

However, halving can also be seen as bad for miners, as it reduces the block reward that they receive for their work, which could potentially lead to a decrease in the security of the Bitcoin network if miners decide to leave. Ultimately, the long-term effects of halving the Bitcoin market and network are uncertain and will depend on a variety of factors.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

Earning income through crypto mining? This guide will help you understand how your mining rewards are taxed in the USA.